Resources

- Field Guide

- Other Documents

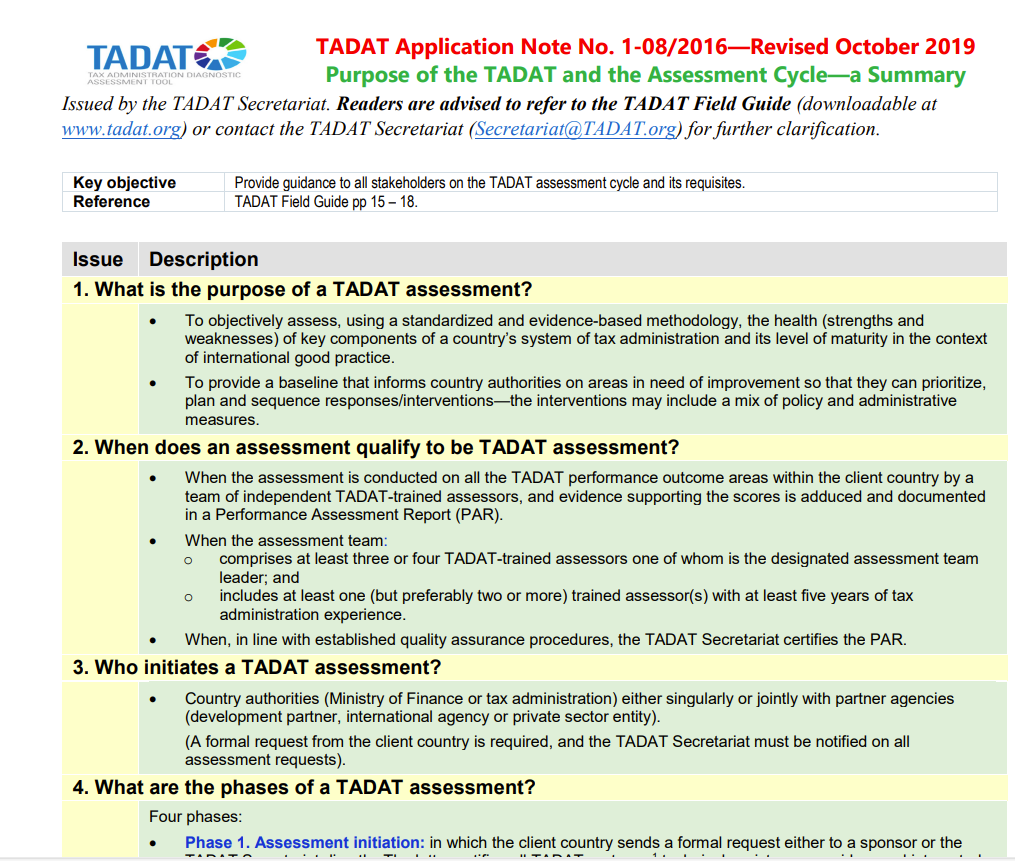

Provide trained assessors with a structured methodology—the Tax Administration Diagnostic Assessment Tool (TADAT)—to undertake an objective performance assessment of a country’s tax administration system.

Establish a set of quality standards to be applied in conducting an assessment and preparing a PAR.

Ensure consistency of approach amongst assessors.

The field guide is organized around the nine Performance Outcome Areas (POAs) of the TADAT framework, with each section detailing the desired outcomes, international good practices, and the indicators and scoring methods used to assess performance.

It includes a checklist of guiding questions for assessors—meant to be flexible and supplemented by professional judgment—as well as examples of evidence required to support scores, such as policy documents, data, and field observations.

A performance measurement matrix outlines criteria for scoring, again requiring assessor discretion in complex cases.

Appendices provide essential tools and templates, including a glossary, pre-assessment questionnaire, fieldwork schedule, reporting formats, evaluation forms, and a description of the quality review process.

TADAT FIELD GUIDE

Publications and Other Documents

Welcome to the premier hub for all things TADAT — the Tax Administration Diagnostic Assessment Tool! Dive into a dynamic collection of expertly curated documents and publications designed to enhance your understanding and application of TADAT’s methodologies.

Explore comprehensive reports, practical guidance notes, and insightful case studies that empower you to drive reforms and achieve superior tax system outcomes.